TaxGeek 2006 Ideas Page

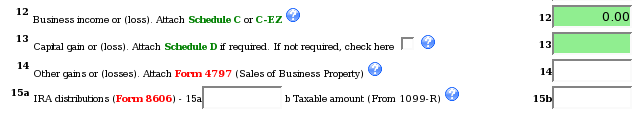

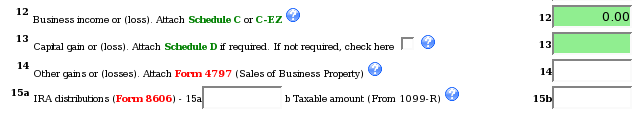

Idea 1: Greening out 1040

Form 1040 in TaxGeek supports all the requisite calculation consistently with IRS standards. However a number of forms that

branch off of the 1040 are not supported: the user must compute those forms by hand and enter the result in the 1040. Such

forms show up in red in TaxGeek, whereas supported forms show up in green.

We wish to "green-out" the 1040 showing

full support for the major branching forms by Summer's end 2007. This means that the following forms

still need support:

- Form 4797 - Sales of Business Properties. Multiple instances possible.

- Form 8606 - IRA Distributions.

- Schedule F - Farm income or loss

- Form 8889 - Health Savings Account Deduction

- Form 8903 - Domestic Production Activities Deduction

- Form 8814 - Tax on Investment Income of Certain Minor Children

- Form 4972 - Tax on Lump Sum Distributions - Multiple instances possible

- Form 6251 - Alternative Minimum Tax - Major headache - may require alternate calculation of a number of forms

- Form 1116 - Foreign Tax Credit

- Form 8396 - Mortgage Interest Credit

- Form 8839 - Qualified Adoption Credit

- Form 8859 - District of Columbia First-Time Homebuyer Credit

- Form 3800 - General Business Credit - Multiple instances possible - MANY subforms

- Form 8801 - Credit for Prior Year Minimum Tax - Individuals Estates and Trusts

- Form 4137 - Social Security and Medicare Tax on Tip Income not Reported to Employer

- Form 5329 - Additional Tax on IRAs, other Qualified Retirement Plans, etc.

- Schedule H - Household Employment Taxes

- Form 2439 - Notice to Shareholder of Undistributed Long-Term Capital Gains - Multiple instances possible

- Form 4136 - Credit for Federal Tax Paid on Fuels

- Form 8885 - Health Coverage Tax Credit

- Form 8913 - Credit for Federal Telephone Excise Tax Paid

Some of these forms can have multiple instances and will need to use the same sort of interface

as Schedule C has (as of version 06d). Other forms are exceedingly complicated

due to the fact that they have many subforms, or need pass-throughs from other

forms, or will require additions to lines that already seem well-defined on

Form 1040.

Developers who are interested in helping with this effort should contact lead

developer Tim Niiler at (niiler -aT - users - dot- sourceforge .dot. net).

HTML experience but no JavaScript? Use one of the existing forms as a model and

submit a "cosmetically correct" form as a starting point for the Javascript coders.

![Software Freedom Law Center [frdm] Support SFLC](http://www.softwarefreedom.org/img/support-sflc.png)

![]() Home

Home![]() News

News![]() Ideas

Ideas![]() Forums

Forums![]() FAQ

FAQ![]() Installation

Installation![]() Download

Download![]() Developers

Developers![]() Links

Links